THE COST

Retain unique programs that provide real-life experiences and skills; maintain class sizes.

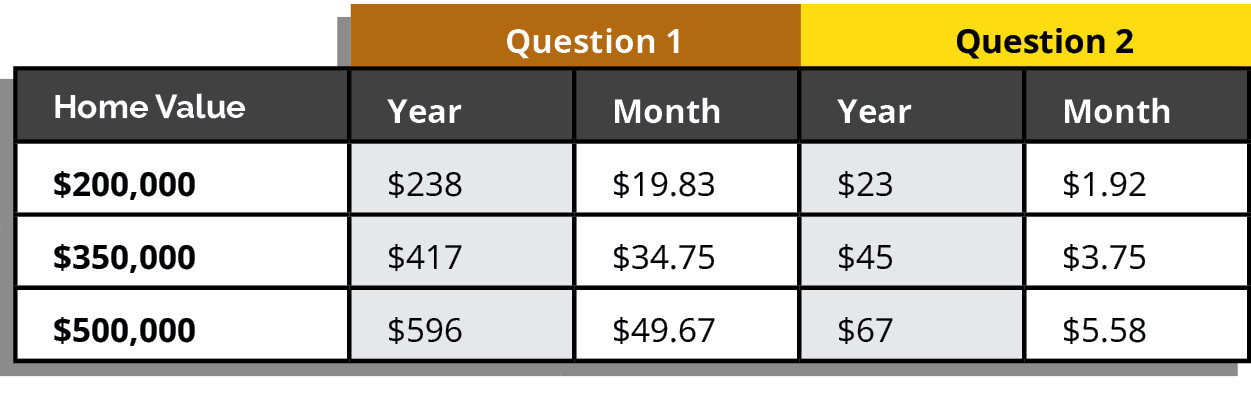

What It Costs - The Financial Impact to Home Owners:

Question 1 (Operating Levy)

$34.75 per month on a $350,000 home (the average home value in Byron)

Question 2 (Technology Levy)

$3.75 per month on the same home (Question 2 can only pass if Question 1 passes)

Combined total: $38.50 per month on an average-valued home

Tax Impact on Three Home Values

Calculate your Personal Tax Impact

Click below to visit the tax calculator and determine the specific tax impact for your home and agricultural property.

School district operating levies only apply to one acre of agricultural land surrounding the house and garage. Capital project levies apply to all agricultural acres. If you have any questions regarding your agricultural property tax impact, please contact Roxy with the Ehlers Public Finance Advisors School Finance Team at (651) 697-8584.